Glamping? Staycations? Buffets?

Discover Top 3 Travel Search Trends in Hong Kong’s Post-COVID Optimism

While travel plans have been decimated due to the pandemic, people have flocked online for travel inspiration—liking, commenting, searching, and engaging with travel brands and content as a means to dream of that next perfect getaway.

And with global vaccine rollouts, traveler confidence is growing. In APAC alone, 54% of people agree that the situation is improving enough to have hope for near-future travel.

For Hong Kong residents in particular, and their insatiable appetite for travel, the recent vaccine rollouts in the region carry a sense of optimism for a quick rebound.

According to a Booking.com travel survey, almost all Hong Kongers—97%, in fact—have searched for travel inspiration this year, while approximately 30% have searched potential destinations as often as once per week. Going forward, this will undoubtedly translate into even greater appetite for tourism content in 2021 and beyond.

To understand travel demand in Hong Kong—from seeking experiences to dream destinations—let’s examine the region’s top 3 travel topics and how you can rank for them on Google.

Similar to our research on travel search trends in China and Singapore, we used Dragon Metrics—an all-in-one global SEO research tool—to understand popular search terms specific to Hong Kong.

Hong Kong Travel Search Trend 1: “Glamping”

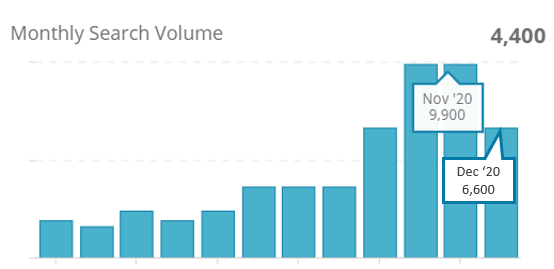

Monthly Search Volume: “Glamping”

Monthly search volumes (MSVs) for outdoor experiences on Google Hong Kong grew significantly over the year. In particular, “glamping”—the portmanteau of glamorous camping—peaked at 9,900 searches in November 2020 and was still going strong at 4,400 in March 2021.

With residents being confined at home for more than a year, it is no surprise that Hong Kongers are wanting to reconnect with nature and seek an escape into the great outdoors.

Monthly search volumes for “Glamping” on Google HK

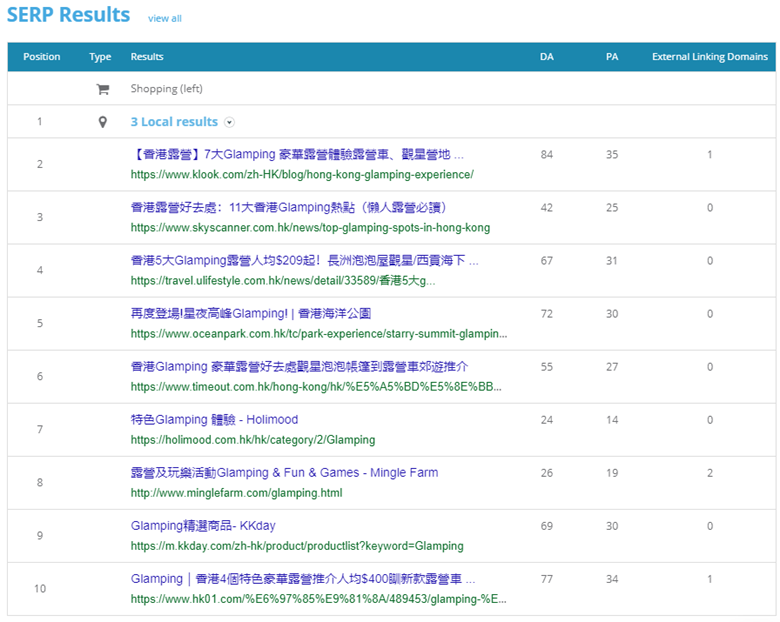

Top 10 Search Results: “Glamping”

Dragon Metrics lists the sites currently occupying the top 10 positions on the SERP for any keyword, alongside other ranking data, including:

- Page authority (PA)—out of 100

- Domain authority (DA)—out of 100

- Backlink volume for each domain

Delving into the competitive analysis for “glamping,” let’s observe which sites populate the SERP for that search term.

As you can see, online travel sites (OTAs) and travel blogs occupy most of the top 10 results for “glamping.” This is expected given that Hong Kong glamping venues don’t tend to have dedicated websites. Instead, they rely largely on positive customer reviews on OTAs and blogs (as well as social media) to promote themselves.

However, many of these sites have low PAs (between 14 to 35) and moderate but varying DAs (between 24 to 84), hinting that it might be relatively easy to outrank them by creating high-quality content for this keyword.

Hong Kong Travel Search Trend 2: “Staycation 優惠”

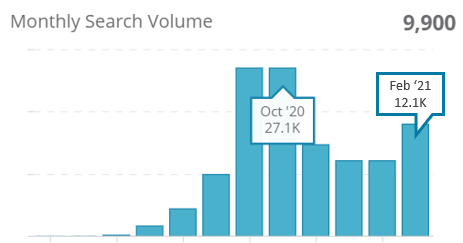

Monthly Search Volume: “Staycation 優惠”

Leisure travel for Hong Kong residents has been disrupted since early 2020, though that hasn’t deterred them from satiating their wanderlust locally.

Online searches on Google HK for “staycation優惠” (staycation offers) have dramatically increased since May 2020. The term peaked at 27,100 MSV in September and Oct 2020—when daily COVID-19 cases consistently remained very low.

As of February and March 2021, demand for staycation offers still exceeded 12,100 and 9,900 MSVs, respectively.

Monthly search volumes for ‘staycation優惠’ on Google HK

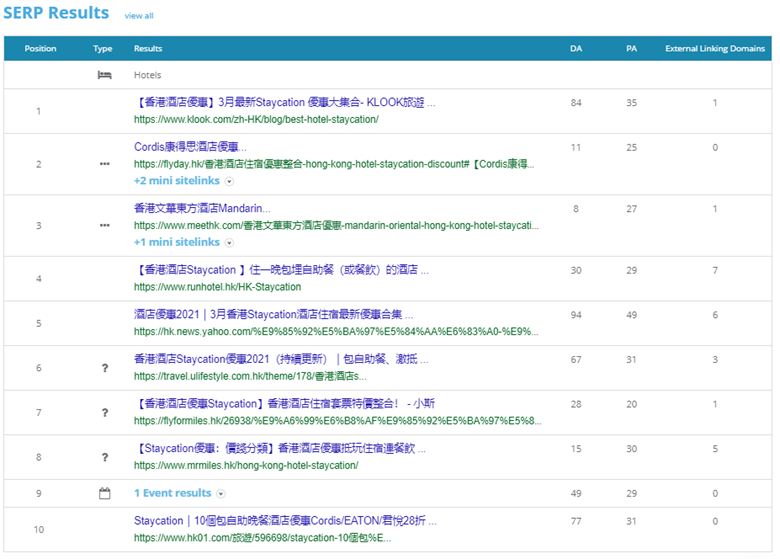

Top 10 Search Results: “Staycation優惠”

Using Dragon Metrics, let’s observe who ranks in the top 10 on the SERP for “staycation優惠”:

Similar to the “glamping” SERP, OTAs and travel blogs occupy most of the first page for “staycation優惠.” This is likely down to their ease of use, where a lot of information on different packages is concentrated and backed by reviews from customers and KOLs.

Once again, most of these sites have low PAs (20 to 49) and varying DAs (8 to 94). As such, ranking above these sites for “staycation優惠” may not be too challenging if you create a piece of high-value content that shares what great staycation deals are happening and how well-received they are.

Hong Kong Travel Search Trend 3: “自助餐優惠” (buffet deals)

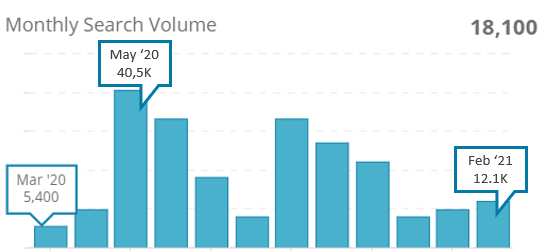

Monthly Search Volume: “自助餐優惠” (buffet deals)

Hong Kong is a culinary paradise, and despite the policies currently restricting the full dining experience, the locals still love a good buffet.

Over the past 12 months, MSVs for “自助餐優惠” (buffet deals) ebbed and flowed between 5,400 searches in March 2020 and 40,500 in May 2020. At the time of research, the MSV in mid-March 2021 was at 18,100, which we expect will grow in the coming weeks and months as vaccines rollout and social distancing restrictions ease.

Monthly search volumes for “自助餐優惠” on Google HK

Top 10 Search Results: 自助餐優惠

Once again, we can use Dragon Metrics’ keyword research tool to identify the top ranking competitors for “自助餐優惠”:

Dragon Metrics: Top 10 SERP results for “自助餐優惠”

Much like the SERP results for “glamping” and “staycation優惠”, the SERP results for “自助餐優惠” are dominated by lifestyle blogs, media sites, and OTAs. Based on these sites’ moderate to low PAs and DAs, and their weak backlink profiles, outranking them for “自助餐優惠” won’t be too difficult if your on-page and off-page SEO are optimized and supported with relevant backlinks.

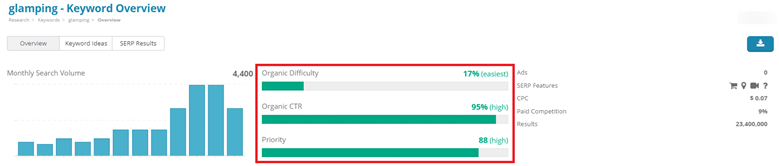

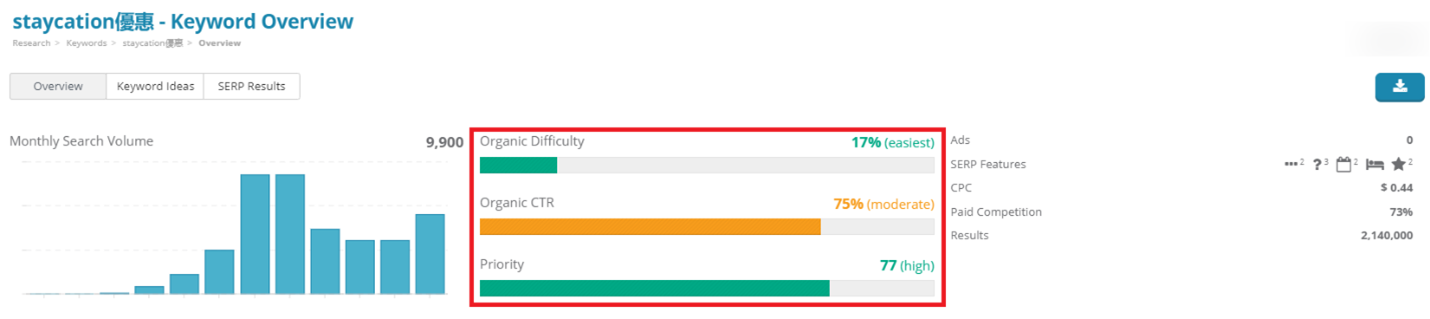

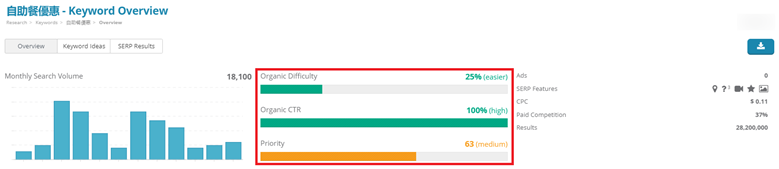

How to Target the Right Travel Keyword

After you’ve identified target travel keywords from competitive analysis, Dragon Metrics’ keyword research tool can help prioritize the keywords for which you have the best likelihood of gaining traffic. The platform uses these metrics in its assessment:

- Keyword difficulty

Keyword difficulty measures the backlink strength of sites ranked on page 1 of the SERP and reveals how many backlinks it takes to rank in the top 10 results.

- Organic CTR

Organic CTR measures how much of page 1 results are made up of ads, rich results, and various SERP features. This illuminates the percentage of clicks that go to organic results and helps you de-prioritize keywords that generate results below the fold.

- Priority

Priority is an aggregate score—made up of search volume, keyword difficulty, and organic CTR—that reveals a keyword’s organic traffic potential. Lower keyword difficulty and higher search volume and organic CTR make for a higher priority score.

As you can see, all three keywords exhibit low organic difficulty, with “glamping” being the easiest to rank for with the least amount of quality backlinks.

“自助餐優惠” has the highest organic CTR at 100%, indicating that the first SERP for the term is mostly organic results. Not far behind, “glamping” saw the second-highest organic CTR at 97%.

According to the priority scores, “glamping” had the highest at 88, followed by “staycation優惠” at 77 “自助餐優惠” (buffet deals) at 63. Given its high priority score, “glamping” can be prioritized in your SEO to break into the top 10 SERP results.

To this end, Dragon Metrics’ priority score is both a time-efficient and reliable metric to evaluate the keyword(s) for which you have the best likelihood of ranking highest.

***

After leisure travel turned all but impossible for most of the world, travel demand looked as if it may diminish—that was not the case. Instead, people went online to read, watch, and comment on all things travel.

Using Dragon Metrics, we found that Hong Kong still experienced high search volumes for travel content over the last 12 months. Indeed, people turned to homegrown activities like glamping and staycations that emulate international traveling experiences. With vaccines gradually becoming available, and the prospect of leisure travel becoming possible again, this demand will only increase over time.

Pro-Tip: As The Egg’s sister company, Dragon Metrics is a proprietary tool developed as the first truly global SEO platform that provides rank tracking, onsite optimization reports, link management, keyword research tools, and more for search engines around the world. In this article, we look specifically at Dragon Metrics’ prowess on Google, but Dragon Metrics works for all of the world’s major search engines, including China’s.