Most Popular Search Engines in Japan – 2024

The Japanese search engine market, while partially similar to global trends, has its own unique characteristics.

First, a trend common to both Japan and the rest of the world is Google’s dominant market share. In Japan, Google accounts for more than 75% of the total market for PCs and mobile devices, mirroring global trends. However, one unique characteristic of the Japanese market is the presence of Yahoo!.

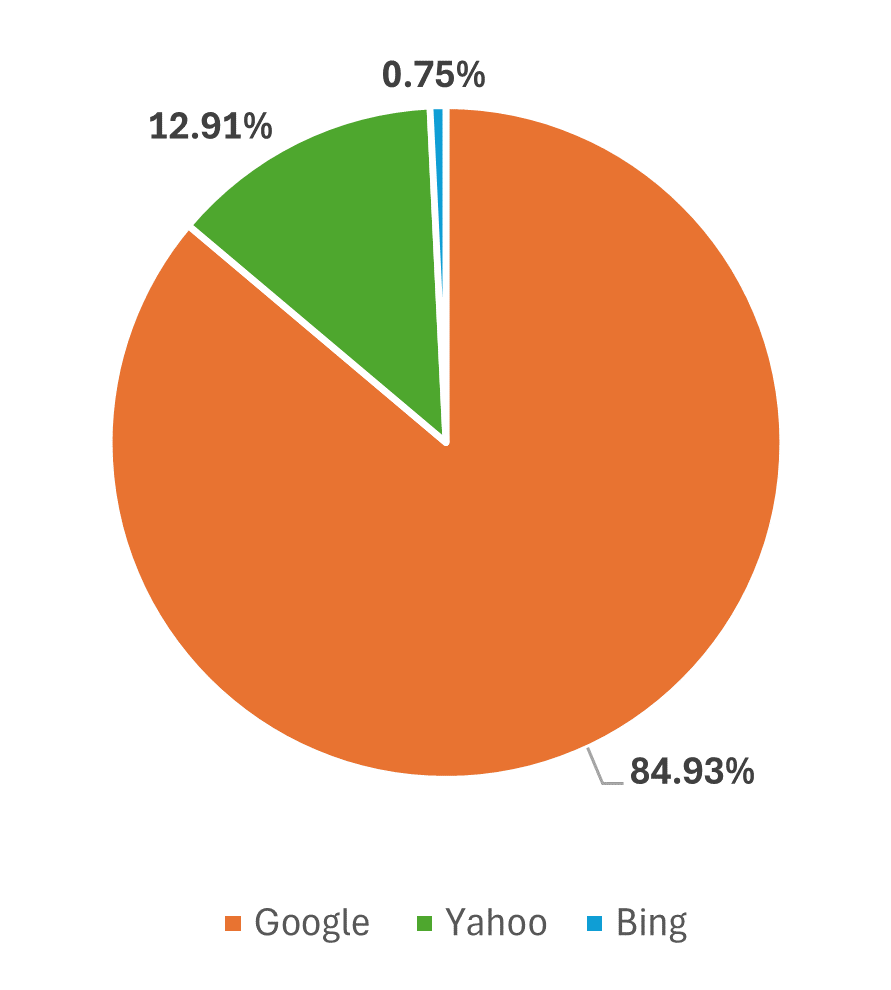

Yahoo! JAPAN maintains a significant share of just under 13% of the smartphone market, a remarkable difference compared to the global market and reflective of the habits and preferences of Japanese internet users.

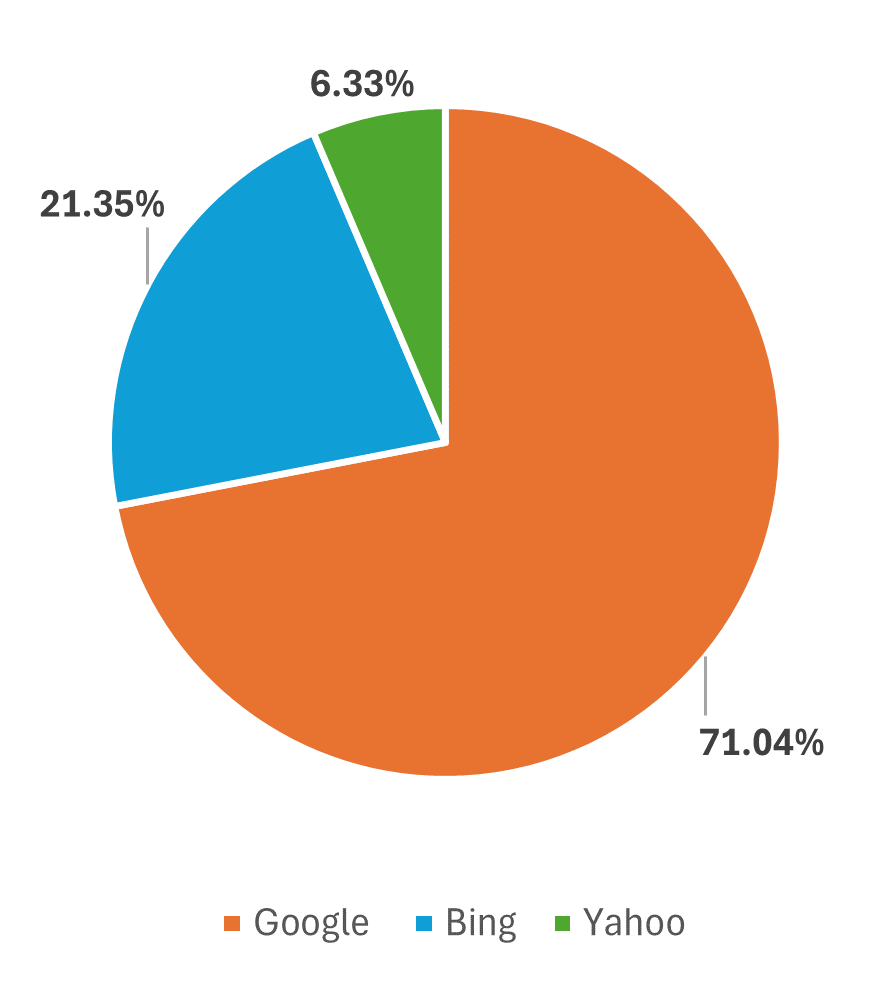

An interesting trend can be seen in the PC market, where Bing’s share is gradually increasing. As of May 2024, Bing’s share has reached 21.35%, compared to the global average of 11.39%. This indicates the growing adoption of Bing among PC users in Japan, exceeding the global average of 11.39%.

This article examines in detail the situation of search engines in Japan, based on the latest available data. We will analyze statistics obtained from reliable sources to provide a comprehensive overview of how Japanese people are using search engines. Let’s take a closer look at the search engine landscape in Japan.

Top Search Engines in Japan By Market Share

Overall |

Desktop |

Mobile |

|

|---|---|---|---|

| 78.17% | 71.04% | 84.93% | |

| bing | 10.72% | 21.35% | 0.75% |

| Yahoo! JAPAN | 9.76% | 6.33% | 12.91% |

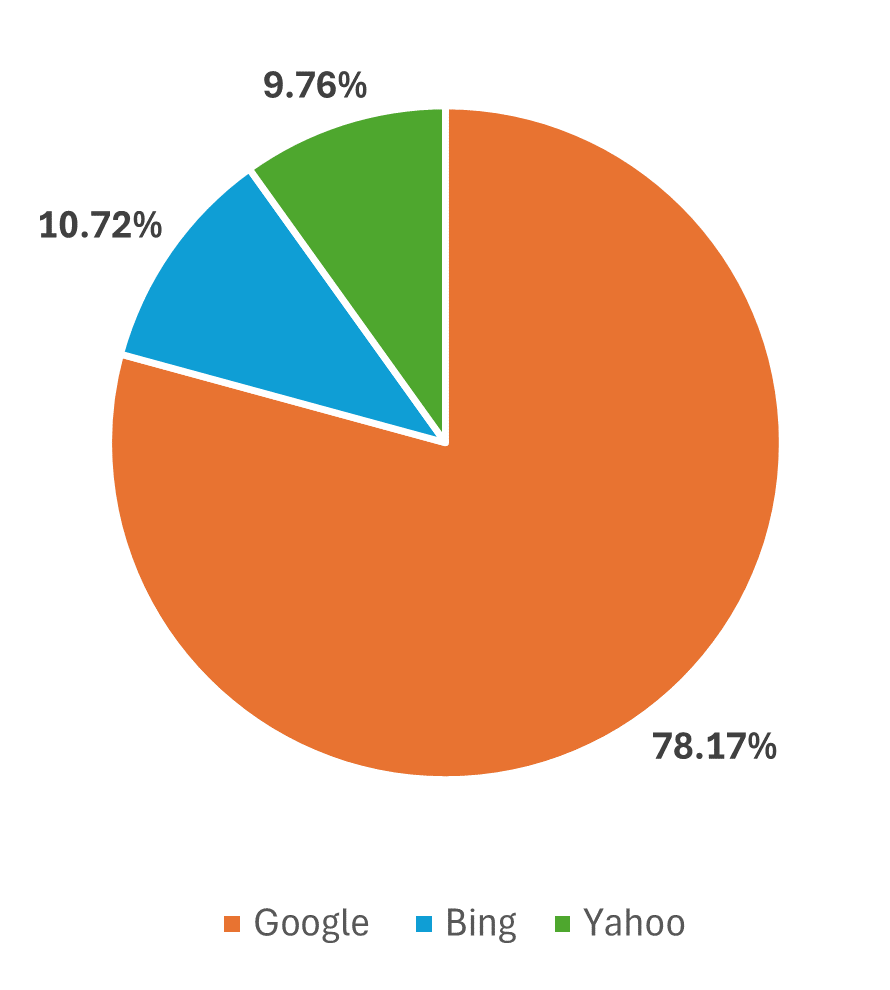

OVERALL

- Google: 78.17%

- bing: 10.72%

- Yahoo! Japan: 9.76%

- YANDEX: 0.34%

- DuckDuckGo: 0.32%

- Others: 0.69%

Source: StatCounter (as of May 2024)

DESKTOP

- Google: 71.04%

- bing: 21.35%

- Yahoo! Japan: 6.33%

Source: StatCounter (as of May 2024)

MOBILE

- Google: 84.93%

- Yahoo! Japan:12.91%

- bing: 0.75%

Source: StatCounter (as of May 2024)

WHAT’S UNIQUE ABOUT JAPAN’S SEARCH MARKET?

Unlike most other markets where a single platform typically dominates the search engine scene with over 90% market share, Japan’s search engine landscape is more diverse. Google and Yahoo are the two most popular search engines in Japan. As of May 2024, Google holds approximately 78% of the market share, Yahoo! JAPAN claims around 9.76%, and Bing has seen a rise in popularity, now holding about 10.72% of the market share.

The search engines’ respective mission statements all target creating a positive user experience:

Google’s mission is “to organize the world’s information and make it universally accessible and useful.”

Yahoo! JAPAN’s mission is “making Japan more convenient with the power of information technology.”

Microsoft’s mission is “to empower every person and every organization on the planet to achieve more”. While we didn’t find Bing’s exact mission statement, it’s worth noting that Bing is owned by Microsoft and operates under this overarching mission

While Google aims to create a universal platform for users all over the world to access a global bank of information, Yahoo! JAPAN leverages that technology to provide the world’s information specifically to Japanese users. Bing, on the other hand, focuses on empowering users through knowledge, which aligns with Microsoft’s broader mission of enabling people to achieve more.

This competitive environment highlights the unique dynamics of the Japanese market, where multiple platforms coexist and cater to different user preferences and needs. The ongoing evolution of these search engines, particularly with the integration of AI technologies, continues to shape the search experience for Japanese users.

Ready to maximize your digital marketing in Japan?

TOP SEARCH ENGINES IN JAPAN: RECENT TRENDS & PAST DATA

THE ORIGINS OF JAPAN’S SEARCH ENGINE MARKET

In 1996, Yahoo! JAPAN was established with an investment from Softbank CEO Masayoshi Son. With the proliferation of PCs and mobile devices, Yahoo! JAPAN rapidly expanded its user base, especially as the default browser for mobile devices.

In 2000, Google entered the Japanese market, already known as a powerful search engine worldwide, and quickly expanded its market share in Japan.

In 2001, Yahoo! JAPAN adopted Google’s search technology, allowing it to leverage Google’s advanced algorithms while maintaining its strengths as a unique portal site.

In July 2010, Microsoft’s Bing officially launched its services in Japan. Bing differentiated itself from other search engines with its development concept of “a search engine that supports decision-making”.

Bing has secured a certain market share, particularly in the PC market, largely due to its default setting as the search engine for the Microsoft Edge browser on Windows 10 devices.

SEARCH ENGINE MARKET SHARE IN JAPAN

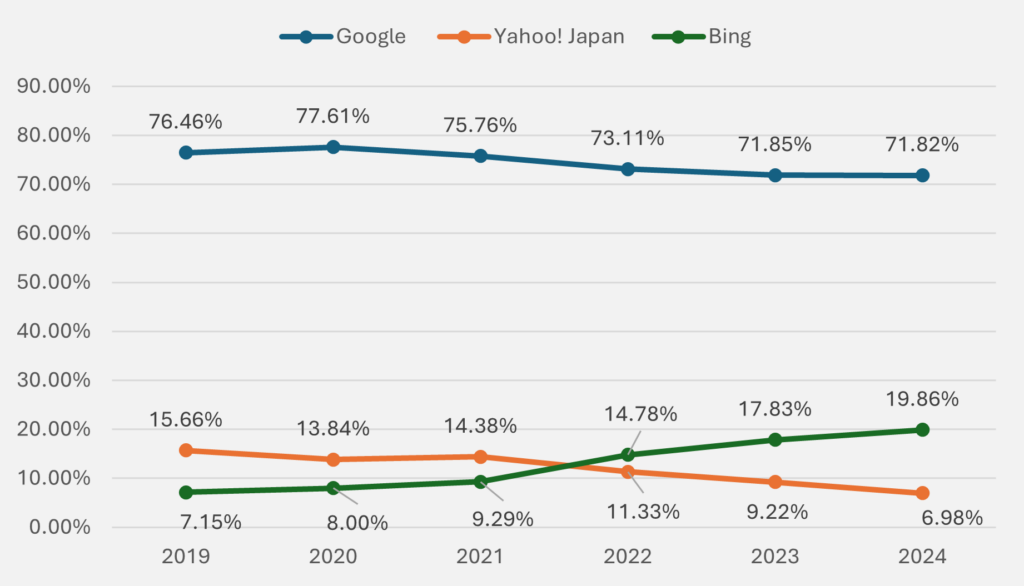

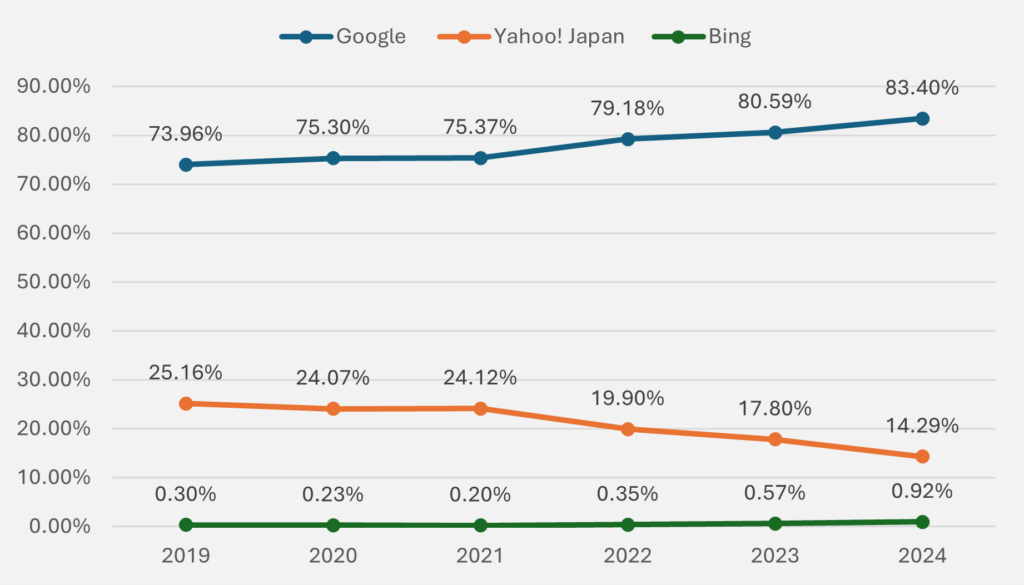

Japan’s search engine market share (desktop): From 2019 to 2024 (as of June 2024)

The desktop search engine market share in Japan has shown significant fluctuations from 2019 to the present. Google has consistently maintained a high market share of over 70% since 2019 and still holds approximately 71% as of 2024.

Google’s dominance can be attributed to its continuous algorithm updates and user-first approach. However, a notable shift has occurred between Bing and Yahoo! JAPAN.

In 2021, Yahoo! JAPAN had a 15% share while Bing had 9%. By 2024, these positions have reversed, with Bing at 19.86% and Yahoo! JAPAN at 6.98%. This change can be attributed to Bing’s aggressive adoption of new technologies, such as its early integration of Copilot (AI assistant). Additionally, Bing’s status as the default search engine for Windows has contributed to its increased market share.

Google has continued to dominate the mobile search engine market share in Japan since 2019, consistently holding a share of over 80%, reaching approximately 85% by 2024.

This significant market dominance can be attributed to Google’s default status as the search engine on both Android and iOS platforms.

Yahoo! JAPAN held a share of approximately 25% in the mobile market in 2019, which decreased to about 14% by 2024.

Bing’s presence in the mobile market remains minimal, accounting for about 1% in 2024. While Bing has made strides in increasing its market share on desktop platforms, it faces formidable competition from Google and Yahoo! JAPAN, the leading search engines in Japan, in the mobile sector.

TOP SEARCH ENGINES IN JAPAN: SIMILARITIES BETWEEN GOOGLE and YAHOO! JAPAN, and how bing differs

Yahoo and Google’s search engine systems are essentially the same. Since 2011, Yahoo has adopted Google’s search engine and search ad serving system, resulting in nearly identical search results, with only minor differences in ranking.

Google’s SERP (left) vs. Yahoo! JAPAN’s SERP (right)

Above is a comparison of organic search results displayed when searching for ‘hits in the first half of 2024’ on Google and Yahoo. You can see that the exact same page is displayed on both search engines.

- SEO Strategy: SEO strategies for Google are also effective for Yahoo! JAPAN. There is no need to develop separate strategies for both.

- User-First Approach: Modern SEO emphasizes the quality of content, regardless of the search engine. This allows for higher rankings on both search engines.

- Advertising Platforms: While organic SEO practices are the same, ad placement requires the use of both Google and Yahoo platforms. This is crucial for maximizing effectiveness in the Japanese search engine market.

Google Ads (right) and Yahoo! Japan Promotional Ads (left)

Bing, on the other hand, is a search engine with unique characteristics:

- User Base: It tends to be used by B2B business users, high-income groups, and educational institutions.

- Technical Features: Bing uses a proprietary search algorithm and offers superior functionality, especially in video and image search.

- Introduction of AI Technology: The company is developing innovative services, such as the implementation of a chat function.

- Marketing Opportunities: Bing can be an effective channel for specific niche markets, high value-added services, and B2B-oriented products.

Therefore, depending on the target audience and the nature of the services offered, appropriate SEO and advertising initiatives for Bing could help build an effective online presence.

top search engines in japan: differences between google vs. Yahoo! JAPAN VS BING

There are key differences between Google, Yahoo! JAPAN and Bing, the three top Japanese search engines.

DIFFERENCES IN ORGANIC SEARCH RESULTS ACROSS SEARCH ENGINES

Yahoo! has diversified its business portfolio beyond internet search, resulting in different items appearing in organic search results on Google and Bing compared to those on Yahoo!

Yahoo! Shopping

For example, when you search for “hair dryer recommendation” on Google or Bing, advertised products appear at the top of the search results, directing you to the advertised pages. In contrast, a search for “hair dryer recommendation” on Yahoo will display recommendations from Yahoo Shopping, the company’s own e-commerce business.

Example of a Google search for “hair dryer recommendation”

Example of a Yahoo! JAPAN search for “hair dryer recommendation”

On Yahoo, Yahoo! News is displayed, while on Bing, news is generated using AI based on multiple online sources.

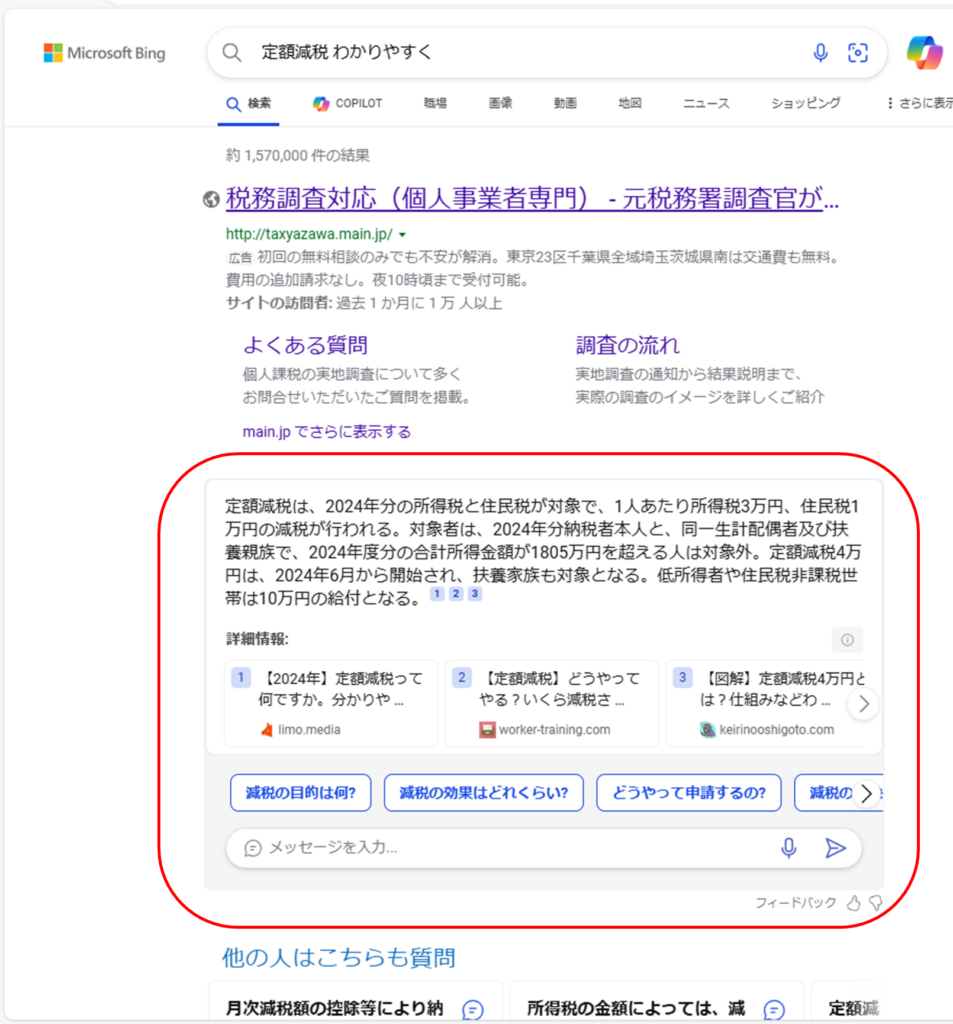

For example, a Google search for “flat-rate tax breaks easy to understand” will display highly current and credible articles at the top of the results.

On the other hand, if you search for “flat-rate tax cuts easy to understand” on Yahoo, Yahoo News, the company’s own media site, will appear, showcasing articles with a high degree of topicality. Bing, meanwhile, generates articles using AI, based on multiple online sources.

Example of a Yahoo search for “flat-rate tax cuts, easy to understand” Yahoo News article is cited.

Example of a Bing search for “flat-rate tax cuts, easy to understand” It generates articles using AI, drawing from multiple online sources.

.

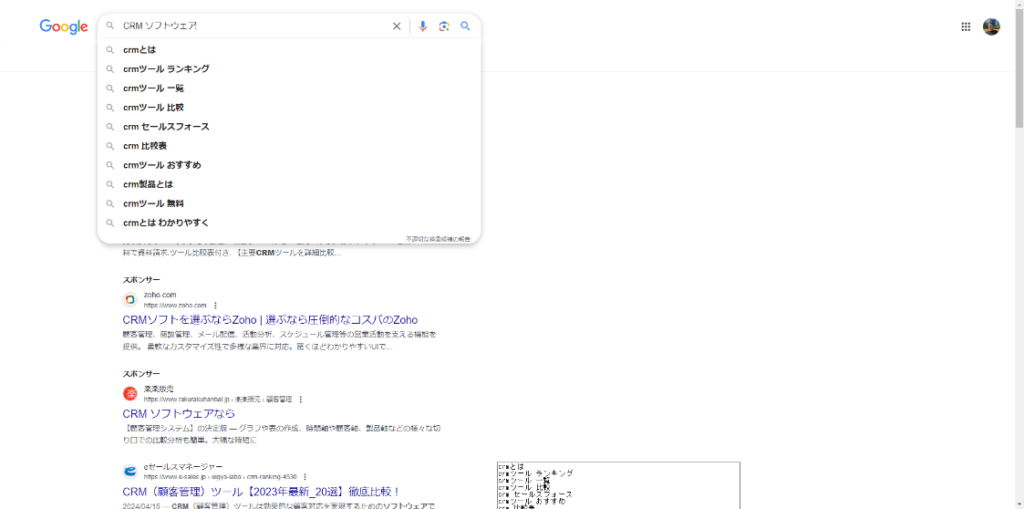

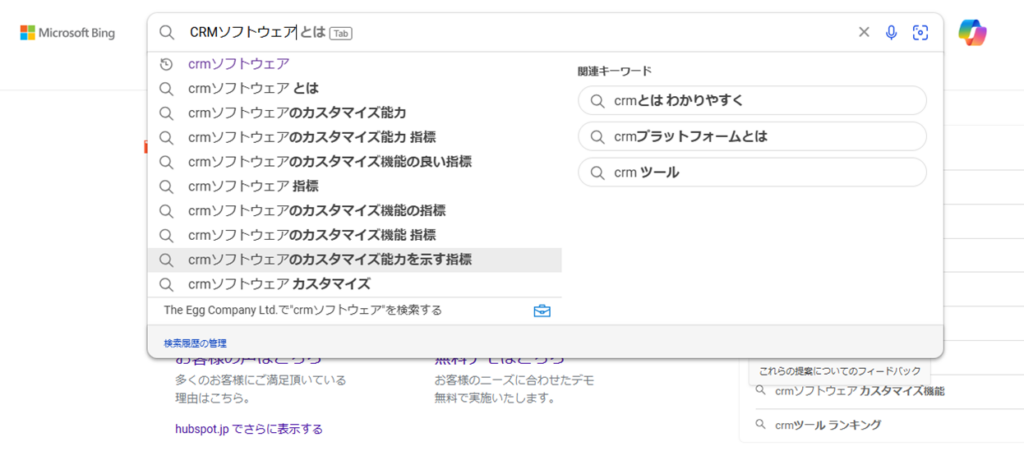

DIFFERENCES IN PREDICTIVE SEARCH SUGGESTIONS

Both Google and Yahoo! JAPAN provide search suggestions by displaying the most likely searches related to the main keyword. Additionally, Yahoo! JAPAN Suggestions also consider the relevance of the keyword and the number of recent searches when generating suggestions. Furthermore, Bing offers a greater number of suggestions compared to Google and Yahoo! JAPAN.

The above compares the results of each suggestion when searching for ‘CRM software.’ It is evident that Bing provides more suggestions than Google.

DISTRIBUTION OF SEARCH ENGINE TRAFFIC IN VARIOUS INDUSTRIES

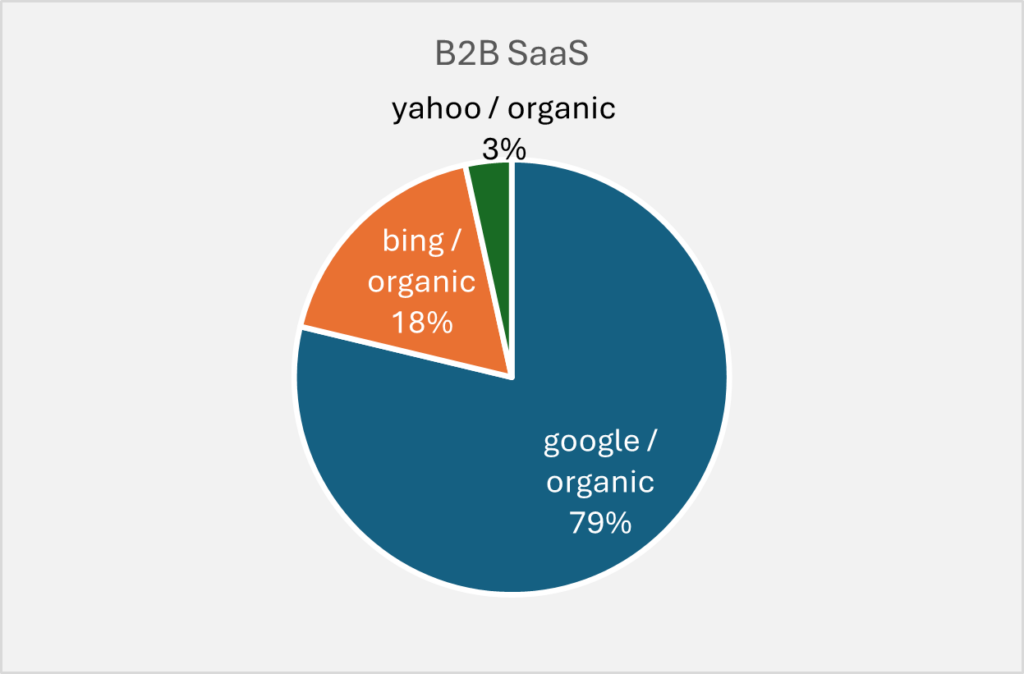

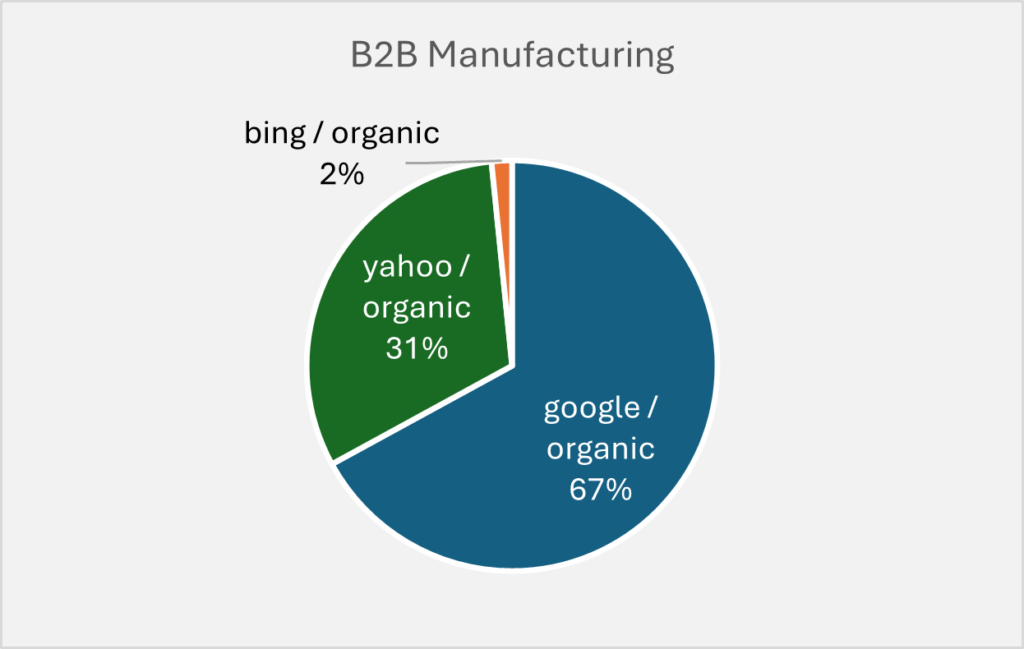

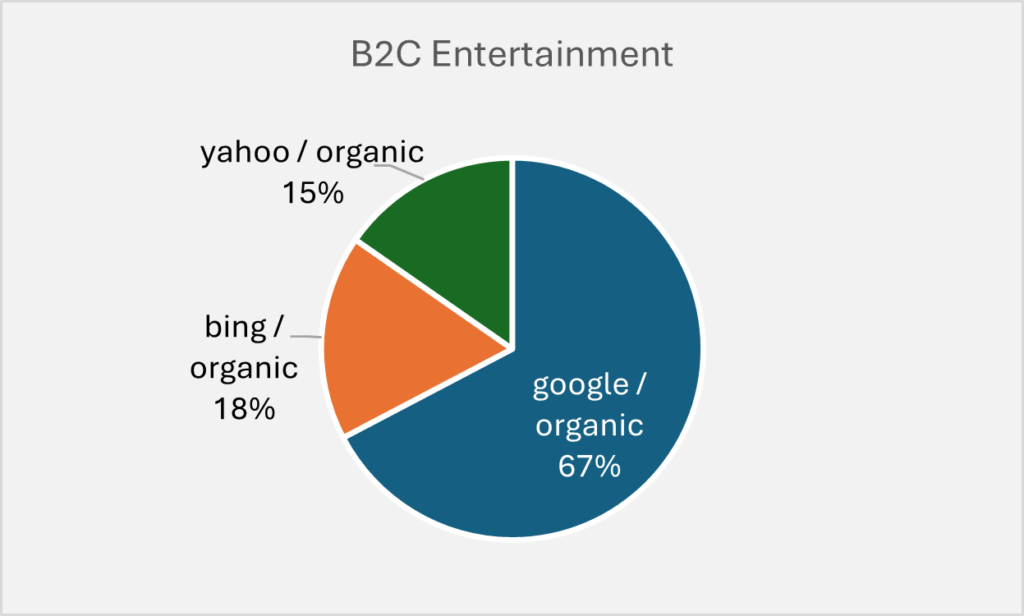

We would like to refer to actual client data that we, The Egg, are responsible for. The pie chart below shows the share of organic traffic for each search engine from January to June 2024, based on Google Analytics data.

Distribution of Search Engine Traffic in B2B Saas

Distribution of Search Engine Traffic in B2B Saas

Distribution of Search Engine Traffic in B2C Entertainment

From the above data, it is clear that Google continues to maintain its dominance as a major source of organic traffic for both B2B and B2C websites. However, we would like to emphasize that the actual share of traffic from different search engines, especially Yahoo and Bing, can vary widely depending on the nature of the website and its target audience.

To maximize the awareness and reach of your brand, it is essential to optimize your search engine optimization (SEO) strategy and set up your advertising accordingly. By doing so, your content will reach the right audience and increase the effectiveness of your digital presence.

In this sense, the discussion should not be about which is the best search engine, but rather about finding the right combination of search engines to suit your business characteristics in Japan.

WHAT IS THE MOST POPULAR SEARCH ENGINE IN JAPAN?

To optimize your online presence in Japan, it is crucial to understand the search engine market there. Google stands out as the top search engine in Japan, accounting for over 78% of search engine usage. Therefore, focusing your SEO and advertising efforts on Google is a strategically sound approach.

While Google Japan holds the title of the most popular search engine in Japan, Yahoo! JAPAN has secured a significant user base due to its unique services and early establishment in the country. It is the second most popular search engine in Japan. Thus, businesses targeting Japanese users should not overlook the potential of Yahoo! JAPAN.

Although Bing holds a smaller market share, it is becoming a valuable platform for companies targeting the B2B sector.

In conclusion, the most suitable Japanese search engine for your company’s needs depends on your specific target audience and business goals. By understanding the strengths and user demographics of each platform, you can develop a digital strategy that effectively reaches your target audience in the Japanese market.

This article has been updated by Akihito Watanabe in 2024.