Search Engine Market Share in Korea 2024: Navigating Korea’s Search Behaviour

In today’s digital era, the reliance on traditional portal search services for information is fading away. While Naver continues to hold its status as ‘Korea’s No.1 Portal’, platforms such as YouTube, Instagram, and X (formerly Twitter) are emerging as popular alternatives, reshaping the search engine market share in Korea in 2024. These platforms cater not only to conventional searches but also offer rich media content attracting diverse user interactions.

Further revolutionizing the search landscape, AI based services, like ChatGPT are changing how information is sought on the Internet. Instead of manually searching through pages of results, users can now engage in a direct, conversational exchange to quickly obtain the information they need. This innovative approach to search, combining AI-powered technology with user-friendly interfaces, outlines an imminent change in how South Koreans navigate and access information online, reflecting a transformation in search behaviours.

South Koreans are increasingly turning to an array of platforms that integrate traditional search functions with social and interactive elements and multimedia formats to fulfill their information/search needs. This article draws data and insights from the recently released Search Trends Report 2024 by Open Survey.

Youtube Taking Center Stage

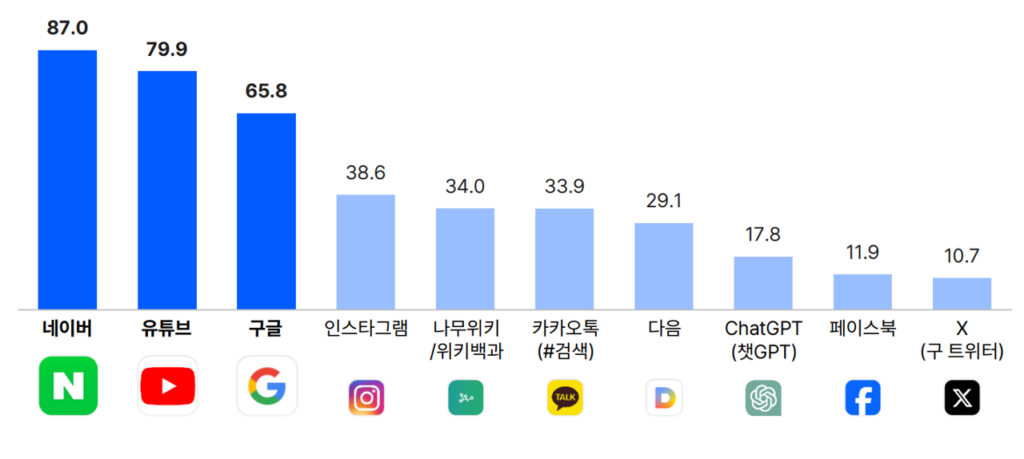

According to the “Search Trends Report 2024” by Opensurvey, internet users’ platform preferences for searching show Naver leading at 87.0%, followed closely by YouTube at 79.9%, surpassing Google’s 65.8%.

Following these, Instagram ranked fourth with 38.6%, followed by Namuwiki/Wikipedia at 34.0%, KakaoTalk (#Search) at 33.9%, and Daum at 29.1%. Notably, ChatGPT secured the eighth position with 17.8%, ranking higher than Facebook at 11.9% and X (formerly Twitter) at 10.7%.

Divergent Search Preferences Across Age Groups

Search platform preferences across age groups

| Age Range | Platform |

| All Ages | Naver, YouTube, Google |

| Age 10-20 | YouTube, X (formerly Twitter), Namu Wiki |

| Age 20-30 | Google, Namu Wiki, YouTube |

| Age 30-40 | Instagram, Naver, Kakao Talk |

| Age 40-50 | Daum, Naver, Kakao Talk |

| Age 50-60 | Daum, Nate, Kakao Talk |

The report highlights distinct preferences across age demographics when it comes to primary search platforms. Naver is favored by the 30s age group, whereas YouTube is more popular among younger demographics (10s and 20s). Conversely, platforms like Google and Instagram resonate more with younger users, while older demographics (40s and above) show less inclination towards said platforms.

Thus, understanding the preferred platforms of different age groups is crucial for crafting an effective content strategy. Businesses should adapt their content formats and messaging to resonate with users on Naver, YouTube, Google, and Instagram, depending on the target audience. Also, business should invest in targeted ads on Naver, YouTube, or Instagram to reach specific segments of the population more effectively.

Key Usage Factors and Platform Performance

Search preferences also vary based on specific search situations or purposes. Users prioritize the reliability of search results when seeking knowledge or news, favoring Google, Wikipedia, and ChatGPT. For place-related or shopping information, they emphasize platforms with minimal advertising, for instance Instagram.

Key usage factors and services by search context

| Search Context | Factors to Consider | Preferred Platforms |

| Knowledge | Are the results trustworthy? | Google

Namu Wiki Chat GPT |

| Place | Is there no promotion or advertising influence? | Instagram

X (Formerly Twitter) |

| Shopping | Does it provide the user’s reviews? | YouTube

Kakao Talk #Search |

| News/Issue | Is there no promotion or advertising influence? | Daum

Nate |

| Education | Does it provide the expected result? | Google

Namu Wiki Chat GPT |

| Life | Are the results trustworthy? | Naver

Daum Nate |

| Content | Does it provide the user’s reviews? | YouTube

TikTok |

WANT DIGITAL INSIGHTS STRAIGHT TO YOUR INBOX?

The Rise of Generative AI and Future Expectations

Despite ChatGPT’s growing awareness (80.8% of users are familiar), its adoption rate (34.5%) suggests untapped potential.

Most individuals (65.2% of non-users) cited the primary reason for not using ChatGPT as “I don’t have many situations where I need ChatGPT, indicating a need for more tailored applications. Similarly, there are users who have tried ChatGPT before but currently refrain from using it for similar reasons. This dual scenario suggests that uncertainty about when to use ChatGPT in specific situations or contexts could impact user engagement and adoption. Understanding the optimal use cases for ChatGPT may help improve its adoption rate and address concerns related to security and answer quality.

As AI technology continues to shape the search landscape, users foresee interactive, multimedia-rich responses. Yet, ensuring data accuracy and trust remains crucial for sustaining search engine credibility.

Future Trends in South Korea’s Search Behaviour and Market Share

In summary, understanding the shifts in Korea’s search engine market share in 2024 is crucial for anyone making digital marketing and content strategy decisions. Naver remains a strong leader, but services not traditionally considered search engines and new players like ChatGPT are starting to change the scene. This makes it more important than ever to have strategies that are both flexible and tailored to the local market.

By staying ahead of these changes, companies can not only improve their reach in Korea but also gain a competitive advantage. It’s about more than just knowing the trends; it’s about using them effectively. Therefore, stakeholders must watch these changes closely to connect with one of Asia’s most dynamic digital audiences.

To find out more about Naver’s adoption of generative AI, read our article “Leverage Naver’s Generative AI: CUE: to Reach Korean Audiences“.